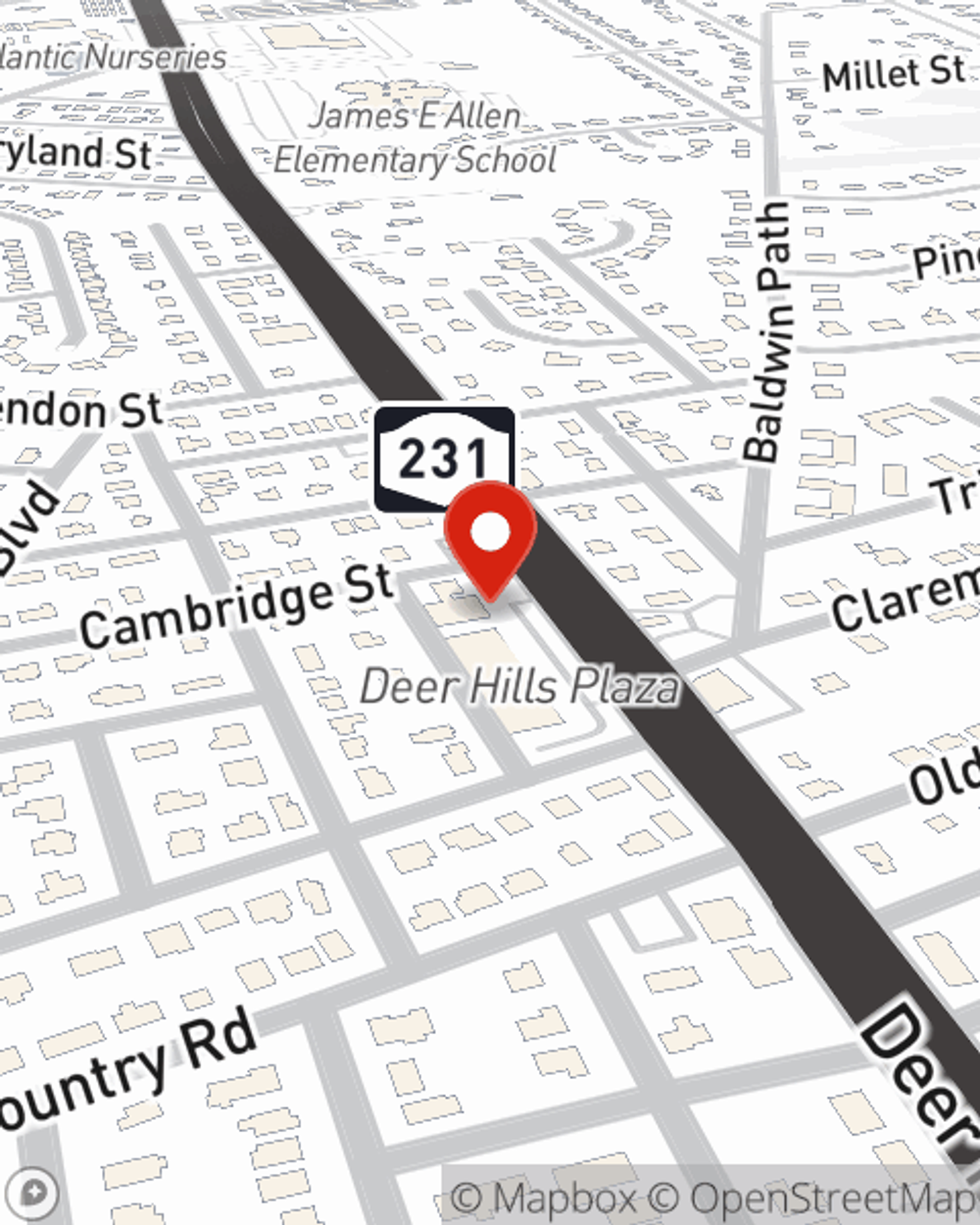

Homeowners Insurance in and around Deer Park

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Deer Park

- Dix Hills

- West Babylon

- North Babylon

- Franklin Square

- Brentwood

- Hauppauge

- Commack

- Melville

- Lindenhurst

- Bay Shore

Insure Your Home With State Farm's Homeowners Insurance

One of the most important actions you can take for your favorite people is to cover your home through State Farm. This way you can take it easy knowing that your home is taken care of.

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Deer Park Choose State Farm

Paul D'Arienzo will help you feel right at home by getting you set up with secure insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect valuable items like your mementos.

Whether you're prepared for it or not, the accidental can happen. But with State Farm, you're always prepared, so you can kick back knowing that your belongings are covered. Additionally, if you also insure your SUV, you could bundle and save! Contact agent Paul D'Arienzo today to go over your options.

Have More Questions About Homeowners Insurance?

Call Paul at (631) 522-1804 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Paul D'Arienzo

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.